Credit Score Guide

Interest rates

Competitive - we negotiate on your behalf!

Loan term

1 to 30 years

Applications

Call us on

Not sure what your credit score is, or how you can improve it? We at Max Mortgages have outlined everything you need to know about credit scores. Continue reading to know more!

What is a credit score and how is it calculated?

A credit score or credit rating is a number that represents the creditworthiness of an individual. Generally, higher credit scores represent better financial behaviour in the past, which may make potential lenders more confident that you will repay your future debts as agreed. Your credit score is calculated based on the financial history found within your credit report. While the factors which can influence your credit score vary depending on the scoring model being used, there are some main factors that could affect your score:

- Your payment history for loans, credit cards and hire purchases

- The total amount of debt you have

- The length of credit history

- The types of credit

- The amount of new credit

- Public records such as a bankruptcy and court judgements

- The number of enquiries recorded on your credit report

A credit score needs to be built up, which means you may not have a credit score or have a low score if you haven’t had enough time to establish a history of borrowing money and prove that you can handle debt responsibly.

How to check your credit score and credit report for free?

There are three credit reporting bureaus in New Zealand, which capture, update, and store consumers’ credit histories:

If you have no idea what your credit score is or what’s on your credit report, you can request a copy of your credit report for free from any of these three credit bureaus. Checking your own credit file falls into the soft enquiry category, and it will not have an adverse impact on your credit score. Once you receive your credit report, make sure that you look it over carefully and check it for accuracy. If you spot an error, you can report it to the credit reporting bureau to request a correction. By regularly checking your credit report, you can also have an accurate view of your current financial health.

Why is your credit score important?

Used by potential lenders and creditors as a decision-making tool, your credit score is a vital part of evaluating your credit health. Not only could it directly affect your chances of landing credit, it may also have an impact on the amount of credit that a lender will make available to you as a borrower, as well as the interest rates and terms you receive. An excellent credit score may translate into hundreds and even thousands of dollars in savings.

What’s more, your credit score may also affect how easily you can rent an apartment, how much you will be charged for auto insurance; and in some industries even whether or not you get hired.

What is a good / bad credit score?

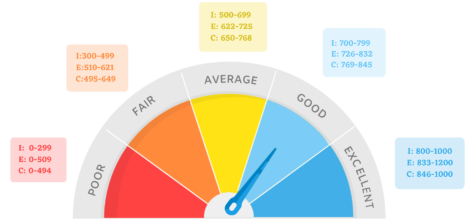

Each credit bureau assesses data differently and not all scores are measured on the same scale, meaning your credit scores will slightly differ for each of the three credit bureaus in New Zealand. A scale of 0-1000 is most common, however, Equifax uses a scale of 0-1200. The below graphic shows a breakdown of credit score ranges from the three credit bureaus.

The definition of a good or bad credit score also depends on the financial provider you’re applying to – an average score in the eyes of one lender, might be a good score in the eyes of another lender.